Quick and cost-effective implementation

Act fast without hurting your wallet.

Simplified process

Don’t get overwhelmed. We are here to provide you with all the necessary information or manage the process on your behalf.

Cater to all transaction types

Including AVS, MOTO, Tokenization, MIT, and CIT.

Cost reduction

Improve your bottom line with our competitive pricing.

Conversion optimization

Enhance your conversion rate by using our built-in optimization services.

Process refinement

Streamline your operations, including reconciliation, for improved efficiency.

Our longtime partners

Embrace the future of payment processing today

Experience rapid deployment thanks to our cloud connectivity, making us one of the first in the market to offer such swift implementation.

Solution's scalability is unmatched, with a 100% cloud-based infrastructure that supports growth without limits. Designed for global readiness, Autopay's system facilitates virtual migration, enabling your business to expand its reach worldwide.

Security is paramount, and with PCI DSS and PCI 3DS certifications, your transactions are safe, adhering to standards recognized by Visa and Mastercard.

We continuously optimize processes, focusing on the business aspect to ensure your operations run smoothly. Our comprehensive API facilitates easy integration, and our supportive approach extends to crucial processes like reconciliation.

Summing up, our solution stands out with its rapid cloud-based deployment, scalability, and global readiness. Coupled with our unwavering commitment to security, ongoing optimization, and extensive support, we are not just a provider; we are your partner in payment processing.

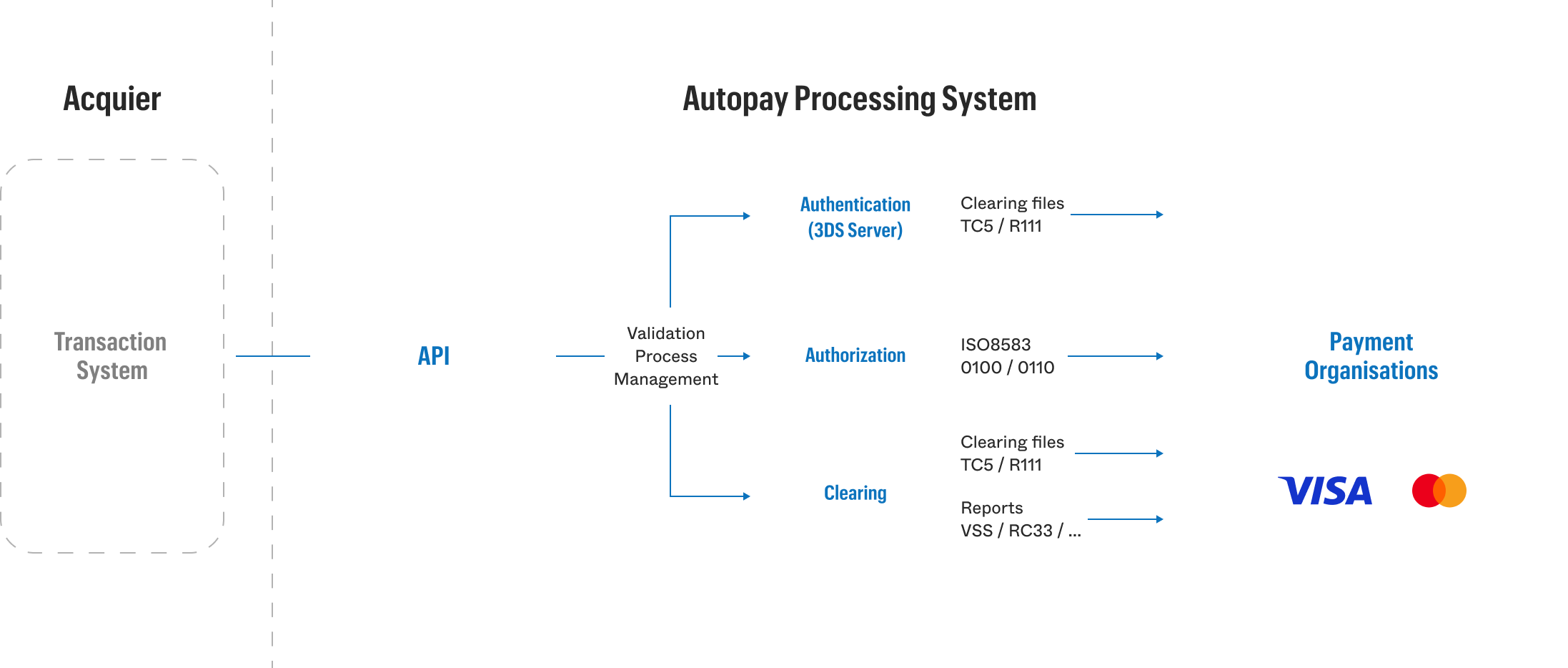

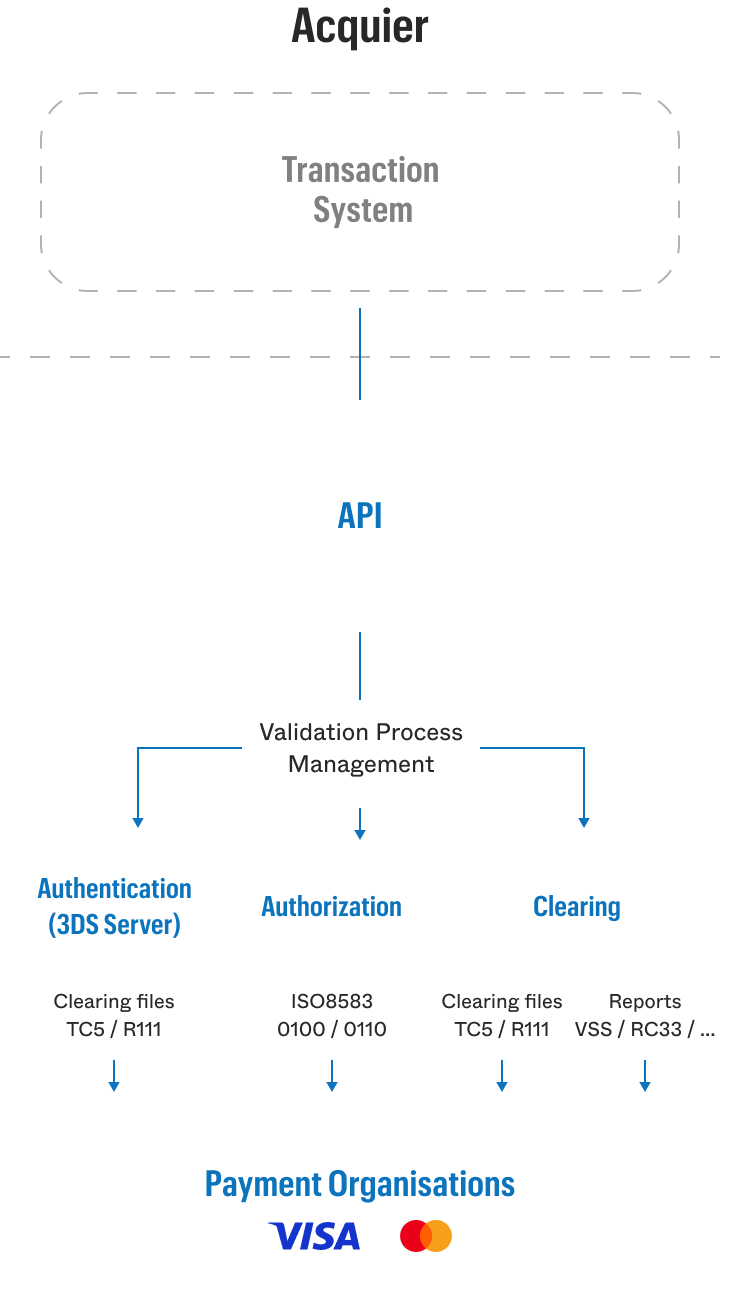

Technical processing (TPP)

Dive into the world of TPP with our sophisticated system designed to handle ISO8583 messaging for authorization and clearing.

All processes in one place

Utilize a system that provides you with end-to-end process support from the perspective of payment organizations. From card recognition, through authentication (3DS Server), to authorization and full transaction settlement.

Target audience

Exclusively crafted for acquirers, our system is built to cater to both newcomers and established entities in the payment processing industry.

Our Visa & Mastercard integration solution perfectly meets the needs of:

Financial institutions

Banks and financial services companies that act as acquirers, processing credit and debit card payments on behalf of merchants.

Payment processors

Companies that provide payment processing services to merchants, needing robust backend systems to handle authorization, clearing, and settlement of transactions.

Fintech companies

Technology-driven financial companies looking for scalable, secure, and efficient payment processing solutions to integrate into their platforms, especially those focusing on global expansion and needing to comply with international standards like ISO8583.

Payment facilitator who wants to become acquirer

Organizations offering merchant accounts and payment processing solutions to businesses, looking to enhance their offerings with advanced technical processing capabilities.

Elevate your business

Expand payment capabilities

By broadening your payment options, you are not just accommodating more transaction types; you are opening your business to a global market. This expansion isn't just about diversity; it's about making your services accessible to a wider audience, ensuring you never miss an opportunity due to payment limitations.

Build revenue with strategic insight

By leveraging our competitive pricing and state-of-the-art optimization services, you are positioned to enhance your bottom line significantly. Our solution is designed to streamline your operations and reduce costs, while simultaneously opening new avenues for revenue through expanded payment options and improved customer satisfaction.

Optimize conversion for peak performance

By ensuring a smooth, efficient, and user-friendly process, you'll see higher completion rates, increased customer loyalty, and a notable boost in sales performance. In today's digital age, a seamless user experience is key to conversion. Our payment processing solutions are crafted with this in mind, focusing on optimizing every step of the customer journey.

About Autopay

1999

the year we entered the market

~300

banks and institutions are our trusted partners

50 000

online stores have chosen our online payment solutions

>10 bn

the value of transactions handled by us in 2023

Your trusted partner

From October 1, 2013, we enjoy the status of a national payment institution supervised by the Polish Financial Supervision Authority

Since 2011, pursuant to the consent of the National Bank of Poland, we have been conducting clearing and settlement activities supervised by the NBP.

We have obtained the PCI DSS and PCI 3DS certificates, enabling the processing of card data in IT systems and payment gateways.

We are listed as official suppliers for Visa and Mastercard.

Frequently asked questions (FAQ)

ISO8583 is a standard for systems that exchange electronic transactions made by cardholders using payment cards. It defines the format and elements of the message structure for communication between acquirers and payment networks, and other financial transaction messaging. This standard is widely used in the financial industry for transaction messages.

This is the process by which the system verifies that the cardholder is able to make a purchase (has enough funds or is technically available). The authorization process involves sending a request from the acquirer system to the issuing bank (via networks like Visa or Mastercard) to hold the amount of the transaction.

We enable the processing of any types of transactions from payment organizations such as: Purchase / Recurring / Customer Initiated Transaction (CIT) and Merchant Initiated Transaction (MIT) Initial and subsequent / Token / Click2Pay / Account Verification Services (AVS) / Mail order / Telephone order (MOTO) / Dynamic Currency Conversion (DCC).

After a transaction is authorized, clearing is the process of exchanging financial information and transferring funds between the acquirer (merchant's bank) and the issuer (cardholder's bank) to reconcile and settle the transaction. This involves the actual movement of funds and adjustment of accounts.

Payment Card Industry Data Security Standard is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. It was established to reduce credit card fraud and protect cardholder data across the globe.

PCI 3-D Secure is a security standard for card-not-present transactions, providing an additional layer of security for online payments. It involves a real-time authentication step where cardholders must verify their identity before a transaction is approved, significantly reducing the risk of unauthorized use of a card.

Both certifications are critical for businesses involved in the handling of payment transactions, ensuring that sensitive payment information is protected through stringent security measures.

TC33, TC10, and TC05 are types of messages that are used to facilitate the clearing process of transactions. They are used for bidirectional communication to settle a payment transaction. Based on our experience, we have developed a mechanism that creates dedicated files for settlement and reconciliation processes on the acquirer's side, based on the received messages. Additionally, we provide support for files such as VSS, which enable confirmation of the correctness of settlements.

CGMS 1240 and 1644 are types of messages that enable full support of the reconciliation process on the Mastercard system side. By using the appropriate messages, we communicate with the GCMS system to manage clearing and its confirmation. Thanks to the support of all message types, we create dedicated settlement reports that facilitate the handling of the settlement and reconciliation process. We also provide reports necessary for the process of calculating interchange fee costs.

Contact us

Connect with us to learn more about our future-proof solutions designed for businesses looking to scale. Let's discuss how we can tailor our services to support your evolving needs.

Get in touch